Sunday, October 26, 2008

Paulson Won't Get Bank Loans from his Bucks

The bankers gave themselves billions of bonuses each year for all their good works. Hank Paulson makes a fortune of $700 billion. He also successfully lobbies the SEC so these new investments of bad mortgages aren't regulated. President Bush asks him to be Secretary of the Treasurey. When the subprime mortgages starts tanking in 2007 he does nothing. When more mortgages default throughout spring of 2008 he does nothing. Then September, 2008, Paulson announces that the U.S. economy will collapse unless the Congress passes his $710 bailout to buy the bad mortgages so banks will begin lending again. The U.S. citizens voice their opposition 100 to 1, but on Wall State and big business exerts pressure so Congress on its second try passes the bailout. Immediately stock markets crash around the world.

In the October 25, 2008 New York Times Joe Nocera wrote a column titled "So When Will Banks Give Loans?" After Nocera reminds us that Paulson had sold his $700 bailout to Congress as the fastest way to get banks giving loans again, the writer says "the dirty little secret of the banking industry is that it has no intention of using the [bailout] money to make new loans."

Nocera heard a J.P. Morgan Chase banking insider say the $25 billion the bank got from the government "will help us do is perhaps be a little bit more active on the acquisition side or opportunistic side for some banks who are still struggling." In other words, the bank is thinking of using its money to acquire other banks. The J.P. Morgan Chase executive said his bank will not be making more loans. They are hoarding the money.

Nocera adds that Treasury really didn't want its bailout money to go for bank loans but "Treasury wants banks to acquire each other and is using its power to inject capital to force a new and wrenching consolidation." Also, the Treasury Department "recently put in place a new tax break, worth billions to the banking industry, that has only one purpose; to encourage bank mergers." The banking industry should really appreciate Secretary Paulson for giving them such huge tax breaks. Also, Paulson is using the bailout money to turn the U.S. banking system into a "oligopoly" of huge banks--that will hurt rather than help this country. The huge banks will benefit from the bailout but the rest of the country will be big losers. Besides, J.P. Morgan Chase is really sound and didn't need the $25 billion at all.

Nocera then compares Paulson's bailout with the British government's. Paulson's bailout gifts the money to banks while only recommending they give loans while the British government mandated lending as a requirement for getting the capital. Because of Paulson's toxic bailout investors for good reasons won't trust the financial system and won't invest. The stock market will continue to fall. People will continue to lose jobs and homes by the hundreds of thousands.

First, Paulson's bank Goldman Sacks is one of the key plays in creating the housing bubble--they profit mightily. Paulson's bailout was a con job to help a few big banks including his own Goldman Sacks but is harming the whole U.S. economy. Paulson's own billions in Goldman Sacks stock and has huge conflicts of interest. He'll go down in history injecting taxpayer money into big banks, one of whose stock he owns. He's a greedy little man and a low class grifter, but our tragedy is he's the Secretary of the Treasury.

Saturday, October 18, 2008

How People Can Improve the Economy

So let's see what people did in the 1st years of the Great Depression when Secretary of the Treasury Mellon was yelling liquidate the banks, liquidate the farmers, liquidate the workers and unemployment climbed to 25% by 1932

People organized Unemployment Councils from 1930-32 that demanded unemployment (there was none at the time) and food from the local governments. In the hunger marchers which culminated on International Unemployment day on March 6, 1930, the marchers in many cities demanded unemployment relief, and they wanted to "work for wages." The Communist Party and its allied organizations were the main organizers of the Unemployment Councils which stopped evictions and asked city governments for relief--food and small change.

By 1931 hunger marchers in 12 state capitals demanded relief and unemployment insurance. A national hunger march on December 7, 1931, was timed to coincide with the opening of Congress. The December 7 march demanded unemployment insurance and a social insurance system to cover maternity care, illness, accidents, and old age. Local demonstrations and conferences select 1,670 delegates who converged on Washington from four separate columns. The marchers were never allowed to speak to Congress or the president, but their mass meetings brought these issues to be discussed nationally.

In the March 7, 1932, at Ford Hunger March Three thousand marched from Detroit to the Ford employment office in the suburb of Dearborn, a company town where Ford's main complex was located. Most were auto workers and their families. Police gassed the marchers when they were entering Dearborn. Then some marchers threw stones. When the marchers arrive at Ford, the police fired at them, killing five. The cops blamed the Communists and had a witch hunt with raids against left-wing organization, but the Ford hunger marchers held a huge funeral march of 30,0000--the unemployment movement in the Detroit area then grew even stronger.

Also World War I veterans organized the bonus march across the country of 43,000 veterans and their families asking for a bonus they said they had been promised for their war service in spring of 1932. The Bonus marchers arrived in Washington D.C. on June 17, 1932 where they had an encampment. Hoover got hysterical and asked General McArthur to clear out the bonus marchers, so he had has troops shoot at them, killing two.

By 1933 radical farmers were protesting throughout the Midwest. In February 1933, thousands of farmers marched on the new capitol building in Lincoln, Nebraska, demanding a moratorium on all farm foreclosures. The Legislature halted foreclosure sales for two years, but the legislators allowed district judges to decide how long a foreclosure could be postponed or to order the proceedings to go forward anyway. In the first test case ended the judge said the sale to go forward. Farmers and their newspapers demanded higher farm prices, cancellation on payment of feed and seed loans, a moratorium on mortgages and reduced taxes.

The marchers' demands then were adopted by FDR and the Democratic Party and by the 2nd half of the 1930s passed as legislation: unemployment insurance; state relief in food and small amounts of money; disability insurance; social security for the elderly; the W.P.A. and C.C.C. programs that hired the unemployed for jobs; the T.V.A. program to help impoverished farmers in the Tennessee Valley; agricultural subsidies to help farmers. At the end of World War II in 1944 Congress finally responded to the demands of the veterans in the Bonus March by enacting the G.I.Bill of Rights legislation giving education benefits so World War II veterans could get a free college education and low-interest G.I. home mortgages.

So the 99% of the U.S. people who have been against Paulson's idiotic bailouts and Bush's inept economic policies should like the protesters in the 1930-1931 publicly through marches, demonstrations, conferences articulate a set of demands; 1) extend unemployment insurance; 2) have FANNIE MAE and Freddie Mac give new low-interest mortgages to stop forecloses; 3.) allow judges in bankruptcy courts to lower the amount owed in mortgages; 4.) have a government-sponsored green energy program hiring unemployed modeled after the W.P.A. and C.C.C. 5.) have a government program to rebuild roads, bridges etc. hiring unemployed; 6.) single payer national health insurance.

Wednesday, October 15, 2008

Comparing 1929 and 2008

Right now the same problem is occurring: the income of Americans is too low to buy goods and services. Former labor secretary Reich said, "Americans have lived beyond their means because their means have declined. It is necessary that their means be restored." Many Americans turned to credit cards and subprime mortgages because they lacked money. Juan Cole says , ’’The average wage of the average worker is lower now than in 1973 and has been lower or flat for the past 35 years. That's the condition of the 300 million or so Americans.” Cole says 300 million have stagnant wages while we have 3 million Superrich who take home 20% of the national income, owning some 45 percent of the privately held wealth in the US.” The Regan-Clinton-Bush neoliberal economic policies have smashed the middle class and working class enriching the 3 million superrich just like the 1920s.

Hoover’s Secretary of the Treasury Andrew Mellon who was a firm believer in cutting taxes, especially on the rich. In the 1920s Mellon kept on advocating and getting tax cuts for the very rich. The rich put their money saved into the bank as they already had far more than they needed.—this excess savings of the rich and unequal income distribution in the 1920s with a small Superirch and a larger struggling masses helped trigger the Great Depression. Bush like Mellon was all about cutting taxes on the superich. Also McCain’s economic plan is all about cutting taxes—that helped cause the Great Depression. He sounds like the reincarnation of Hoover and his Secretary of the Treasury Mellon.

Secretary of the Treasury Mellon in 1930s had a theory of not bailing out banks, but letting the strong banks survive and the weak banks go bankrupt. Go bankrupt they did, so by 1932 there was panic and runs on the bank until late 1932 when FDR was elected and the banking economy completely collapsed. Ben Barncke, the current head of the Federal Reserve Bank, is supposedly a student of the Great Depression, and is critical of Mellon's not trying to save the faiiling banks of 1930-32. The only problem of Bernacke's analysis is that unemployment steadily rose in the time period while wages fell. What as really driving the economny down was falling wages as Americans bought less and less.

Americans by 100 to 1 were against Paulson’s toxic $700 bailout. First, Congresspeople listened to us, rejecting the bailout but then Wall Street and Chamber of Commerce pressure was applied, so Congress reversed itself, approving the bailout. Then stock markets crashed around the world. It seems that Americans consuming on credit cards were the driving force between global economic expansion, particularly in Asia, buying all those goods from China, Japan, Korean, etc etc. So last month when Americans reigned in our spending, those economies in Asian felt pain. Paulson's bailouts do nothing to help Americans get more money from wages so we can buy more goods and services.

Last Friday financier George Sorros on Bill Moyer’s TV show on PBS told the truth about Paulson’s bailout for the first time on mainstream corporate media: Paulson’s bailout is designed to help bank stockholders. By the way, Paulson owns $650 million stock in Goldman Sacks investment bank so Paulson is helping himself and his cronies. Everything Paulson has done is to bailout out bank stockholders, the people who caused the financial crises by demanding ever increasing profits from the banks and who benefited from ever increasing profts from the banks.

Friday, October 10, 2008

Los Angeles artists have Onyx reunion

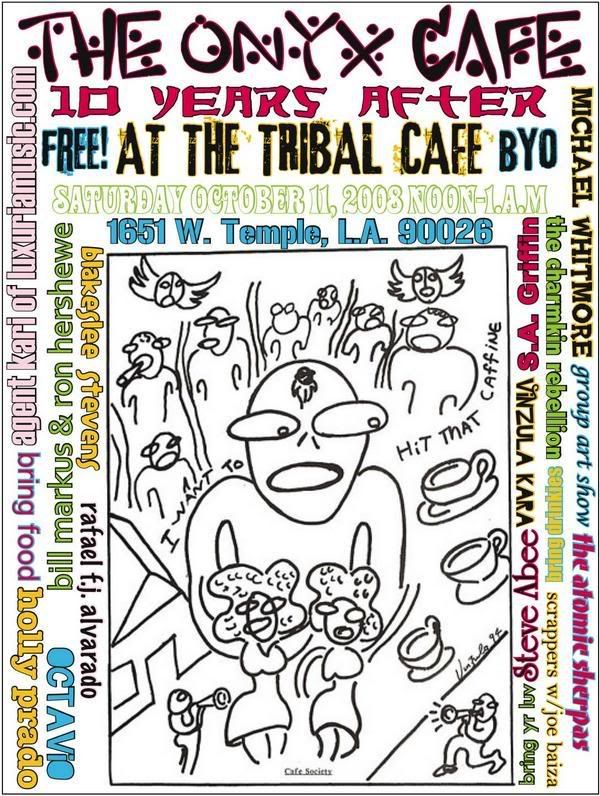

Left- Atomic Sherpas

Left- Atomic Sherpasan artists' cafe that was LA Weekly says 'about the closet thing to '20s-era Paris this town has

ever seen." Yes, I was there from the beginning--it was true. In a tiny

cafe in Silverlake we had poets, painters, rock' musicians, avant garde musicians,

art students--it was a great artists cafe. Run by Fumiko Robinson and John Leech,

it was our home away for home ,our communal artists living room. I read poetry

at the first Onyx art event upstairs which went on for hours.

I will read tomorrow at 2pm followed by leading L.A. poet Holly Prado and 11 more hours. The party will go on until 1 am.

Poet/writer S.A. Griffin brings us The 10-Year Onyx Reunion. Griffin calls it "an old-fashioned Onyx hoedown" with music from Atomic Sherpas, Charmkin Rebellion, Bill Markus, Michael Whitmore and Ron Hershewe bands, poetry by Steve Abee, Rafael F.J. Alvarado, Holly Prado and Blakeslee Stevens. Tribal Café, 1651 W. Temple St., L.A.; Sat., Oct. 11, noon-1 p.m.; free. (213) 483-4458. Pictured: Atomic Sherpas.

....

Monday, October 06, 2008

Tent Cities and Sara Palin

Actually, I've thought the people like Bush and Paulson who go around saying that Congress must pass the bailout or the sky will fall have been first creating fears and then manipulating fears to pass their terrible bailout. Some good things have been happening. The globe in the last few weeks has people using less oil--a good thing as it lessens global warming. The people who created the bubble and frauds in Wall Street have begun to be exposed. People in the United States have been spending less and saving more--a good thing. But now we have to deal with our many problems starting with tent cities growing up across the nation. These people need to be put in homes.

I'm not underestimating our economic problems--the economy lost 760,000 jobs this year including losing 159,000 jobs in September. People move to Reno to try to find casino jobs but no jobs so wind up in tents. They move to California for jobs but no jobs. New York Times reported Friday people in Nebraska are beginning to abandon children as they did in the Depression. We have tent cities going up outside Los Angeles and Reno and other places.

We have a leadership crises where leaders of both parties have been pushing hard for a terrible $700 billion bailout. We have a mass media which focuses on trivia such as Sara Palin's wink rather than she did a dreadful job on the debate last Thursday. When asked what Palin would do about the mortgage crises, she ignored the question. Her recipe for improving the economy is a tax cut as she repeated during the debate a tax cut creates jobs. That's total idiocy, particularly in a month where 159,000 jobs were lost. We've had eight years of Bush tax cuts and lost millions of jobs. Tax cuts do not create jobs. Palin flunked on the debate. Palin should get the Herbert Hoover award for the dumbest comment made about the economic crises. It's time the mass media stopped being so incredibly stupid in how they write about her.

Wednesday, October 01, 2008

200 economists against the bailout

(This letter was sent to Congress on Wed Sept 24 2008 regarding the Treasury plan as outlined on that date. It does not reflect all signatories views on subesquent plans or modifications of the bill)

To the Speaker of the House of Representatives and the President pro tempore of the Senate:

As economists, we want to express to Congress our great concern for the plan proposed by Treasury Secretary Paulson to deal with the financial crisis. We are well aware of the difficulty of the current financial situation and we agree with the need for bold action to ensure that the financial system continues to function. We see three fatal pitfalls in the currently proposed plan:

1) Its fairness. The plan is a subsidy to investors at taxpayers’ expense. Investors who took risks to earn profits must also bear the losses. Not every business failure carries systemic risk. The government can ensure a well-functioning financial industry, able to make new loans to creditworthy borrowers, without bailing out particular investors and institutions whose choices proved unwise.

2) Its ambiguity. Neither the mission of the new agency nor its oversight are clear. If taxpayers are to buy illiquid and opaque assets from troubled sellers, the terms, occasions, and methods of such purchases must be crystal clear ahead of time and carefully monitored afterwards.

3) Its long-term effects. If the plan is enacted, its effects will be with us for a generation. For all their recent troubles, America's dynamic and innovative private capital markets have brought the nation unparalleled prosperity. Fundamentally weakening those markets in order to calm short-run disruptions is desperately short-sighted.

For these reasons we ask Congress not to rush, to hold appropriate hearings, and to carefully consider the right course of action, and to wisely determine the future of the financial industry and the U.S. economy for years to come.

For the whole list of names of the economists, go to the link

http://faculty.chicagogsb.edu/john.cochrane/research/Papers/mortgage_protest.htm